Market Report: Q4/EOY 2025

Executive Summary

By Q4, the NYC office market moved from directional debate to execution. Availability tightened unevenly with demand concentrating in newer, well-located assets, while commodity space continued to lag despite pricing pressure.

Leasing activity remained steady but tenant behavior shifted. Decision timelines shortened, tour velocity increased, and “wait-and-see” strategies largely disappeared, particularly among growth-stage and creditworthy tenants prioritizing quality and certainty.

The data on availability, deal size, and pricing below reflects a market no longer searching for a bottom, but recalibrating around quality and long-term efficiency heading into 2026.

Largest Transactions of Q4

Following a breakout Q3 with approximately 9.5 MSF leased, Manhattan’s office market sustained elevated momentum into year-end, with Q4 leasing volume at 11.9 MSF the most active quarter since late 2019 (RealDeal.) While below Q3’s cycle high, activity remained well above historical averages driven by continued tenant urgency, deal conversions already in motion, and tightening availability in core submarkets. Notably, Q4 also marked a renewed uptick in Downtown leasing activity; a shift from the prior three quarters where demand was more heavily concentrated north of Canal Street. Large-scale commitments and recommitments in Class A assets south of 42nd Street signaled growing tenant willingness to evaluate Downtown for scale, efficiency, and value, complementing Midtown’s flight-to-quality narrative. Together, these dynamics position full-year 2025 leasing volume near 40 MSF, reinforcing one of the strongest annual performances since the pre-pandemic cycle and a market increasingly defined by compression rather than optionality.

Deals completed over 50K SF: 27 – 3.8 MSF

Deals completed over 25K SF: 77 – 5.5 MSF

Bloomberg | 120 Park Avenue | 495,753 SF

Bloomberg L.P. has renewed and extended its lease for 495,753 square feet of office space at 120 Park Avenue, a 26-story Class A office tower in Midtown Manhattan, marking one of the largest office lease transactions in New York City in late 2025. The 11-year renewal, covering 20 floors and select lower-level areas, keeps the financial data and media company anchored at the building.

Moody’s | 200 Liberty Street | 461,000 SF

As Lower Manhattan continues its shift toward a more residential, mixed-use neighborhood through office-to-residential conversions, the remaining Class A assets are increasingly differentiated by cost efficiency. These buildings allow corporate occupiers to secure high-quality, transit-oriented space at a meaningfully more efficient basis than comparable Midtown Class A product as supply tightens.

Millenium Management | 399 Park Avenue | 438,000 SF

Millennium Management executed a 438,000 square foot renewal at 399 Park Avenue in early December 2025, the largest office lease signed in Manhattan during the final quarter of the year. This renewal secured the hedge fund’s extensive headquarters footprint and underscored continued demand from major financial services users for prime Midtown space.

Ropes & Gray | 1211 Avenue of the Americas | 346,000 SF

Global law firm Ropes & Gray executed an approximately 346,000 SF lease at 1211 Avenue of the Americas in Q4, securing a long-term Midtown presence in one of the corridor’s premier Class A assets. The transaction ranks among the largest office leases completed during the quarter and underscores continued demand from top-tier professional services firms for high-quality, transit-accessible space with scale.

Q4: Politics Changed, Leasing Velocity Remained

Mayor Zohran Mamdani:

The election of Mayor Zohran Mamdani in late 2025 introduced short-term uncertainty across the commercial real estate market as stakeholders evaluated his affordability and rent stabilization agenda, along with broader taxation and regulatory proposals. Real estate executives publicly stated they were monitoring early signals rather than immediately altering strategies, and some large firms expressed cautious engagement with the new administration (CoStar.)¹ From a commercial leasing standpoint, many brokers report that tours, active requirements, and deal timelines have continued, with demand and supply fundamentals still at the forefront of decision-making (CRE Daily.)²

As the administration begins to outline priorities and work with industry stakeholders, market participants are treating the transition as a watch-and-evaluate moment rather than an immediate disruption, with leasing and investment decisions still largely driven by capital availability, asset quality, and supply constraints.

Execution Over Exploration

One of the most defining shifts by Q4 2025 was availability. Manhattan’s overall office availability compressed further by year-end, settling around 16.1% availability (16.5% in Q3), down from roughly 19%–20% a year earlier, marking one of the sharpest year-over-year contractions since 2019. Q4 reinforced this tightening across both direct and sublease inventory, with sublet availability declining to approximately 3.0% of total inventory. Once a defining feature of pandemic-era oversupply, sublease space has now fallen to its lowest level in several year, signaling a materially healthier balance between supply and demand heading into 2026.

Comparing Q3 and Q4

Where Q3 was defined by strategic execution, Q4 was defined by compression. Tenant requirements narrowed and options thinned as decision-making became increasingly time-sensitive. Leasing volume held steady but skewed toward transactions driven by near-term expirations, delivery constraints, and a limited ability to defer decisions. Unlike earlier in the year, Q4 activity was less about optimization and more about certainty. Renewals and in place expansions accelerated, competitive processes tightened, and well-capitalized tenants moved quickly to secure quality space before year-end inventory disappeared. The result was a market operating under constraint rather than optionality.

- 1) Cheng, Andria. 2025. “News | Here’s What Real Estate Pros Say Now about New York’s next Mayor.” Costar.com. November 5, 2025.

- 2) Dale, Nina. 2025. “NYC Real Estate Execs Push Back on Mamdani Concerns.” CRE Daily. November 18, 2025.

What’s Trending in SoHo?

NYC’s Most In-Demand Office Neighborhoods | Q4 2025

Over the past 90 days, SoHo has experienced an accelerated drawdown of already limited inventory, with virtually no new supply coming online. The 5,000–10,000 SF segment has become exceptionally scarce as tenants move up decision-making timelines, secure space earlier in the cycle, and increasingly commit to renewals and off-market turnkey opportunities well ahead of historical norms.

Q4 activity in SoHo was anchored by one of the submarket’s most significant institutional transactions in recent years: Scholastic’s sale-leaseback of its longtime headquarters at 555–557 Broadway. The 12-story, 396,000 SF mixed-use building sold for $386 million in an all-cash transaction to Empire State Realty Trust, marking one of the few large-scale office investment trades to close in SoHo this year. As part of the transaction, Scholastic entered into a new 15-year lease for roughly 222,000 SF of office space, with two 10-year renewal options, maintaining a long-term presence in the heart of the district. For the market, the deal delivered two important signals simultaneously: investor conviction in irreplaceable SoHo loft assets at scale, and the creation of meaningful future leasing opportunity, with more than 100,000 SF expected to come online in a submarket where large, contiguous blocks remain exceptionally rare.

Just across the street at 568-578 Broadway (The Prince Building), asking rents on pre-built suites have continued to push higher. Entering Q4, Newmark’s leasing team was quoting $96–$110 PSF; by year-end, despite no suites having transacted, asking rents have increased to $120–$125 PSF. This represents an approximate 19% quarter-over-quarter increase, reflecting landlord conviction and sustained demand signals even amid a notable repricing of the asset.

Nomad’s Choice: 568 Broadway – Partial 5th Fl (8,406 SF) $87.5K / Month ($50m Upgrade👀)

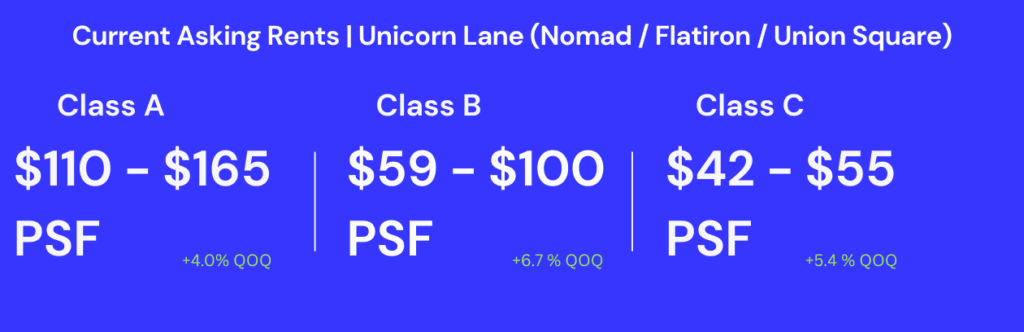

Riding Along Unicorn Lane

NYC’s Most In-Demand Office Neighborhoods | Q4 2025

The Unicorn Lane submarket recorded some of its highest activity on record in Q4, firmly establishing itself as a market driver rather than a niche corridor. Demand intensified across the submarket, with competitive bidding emerging on nearly every high-quality offering, particularly penthouse floors, where scarcity and design-forward layouts continue to command outsized attention.

At 50 West 23rd Street, Two Trees once again demonstrated its ability to outperform competing owners. The 14th-floor penthouse was initially marketed at $81 PSF, yet attracted a four-company bidding process with proposals reaching $88 PSF, representing a 9% premium to ask. Despite the space being delivered in second-generation condition, previously occupied by Astronomer and Kaiyo, the ultimate tenant selection was driven not by headline economics, but by credit quality, signaling a shift in leasing priorities not seen since the pre-COVID cycle.

Beyond traditional assets, VC-backed firms have reshaped Unicorn Lane. Harvey AI, fresh off a $160M Series F, leased ~92,000 SF at One Madison Avenue, joining Coinbase and Sigma Computing in similarly sized October deals as asking rents climbed to $110–$115 PSF; farther south, breakout legal-AI firm Legora took two floors at 836 Broadway, where ZG Capital Group is now pricing its last prebuilt floor at $125 PSF.

The takeaway is clear: as unicorn-valued companies prioritize culture, vibe, and transit access, ownership along Unicorn Lane is achieving triple-digit rents with ease, pricing once reserved exclusively for Midtown trophy assets.

Nomad’s Choice (Off-Market): 1239 Broadway – Entire 13th Fl (12,000 SF) $60K / Month

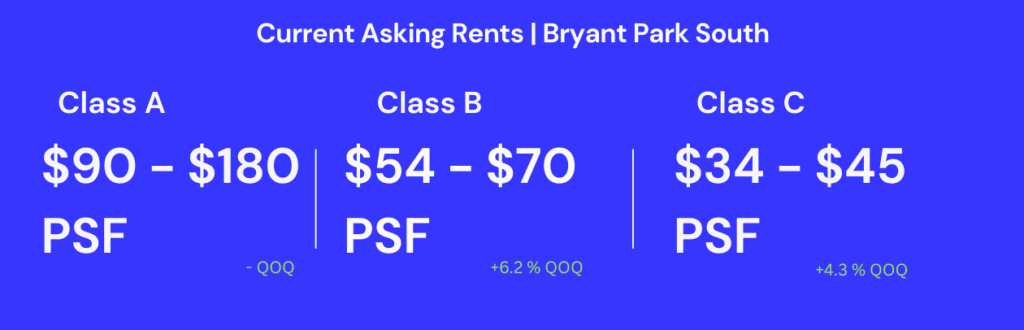

Bryant Park South’s Value Edge

NYC’s Most In-Demand Office Neighborhoods | Q4 2025

Heading into Q4, Bryant Park South continued to operate as one of Midtown’s most efficient leasing corridors, with demand remaining concentrated around Sixth Avenue and the immediate Bryant Park orbit. What carried over from Q3 was not just activity, but compression, fewer high-quality blocks, faster decision-making, and landlords increasingly dictating terms as year-end inventory thinned. Midtown Manhattan’s overall availability rate tightened significantly, falling to around 15% in recent months, making it one of the lowest levels seen since early 2021.

Leasing Velocity & Tenant Behavior

Leasing activity through Q4 skewed toward tenants prioritizing certainty, immediacy, and transit adjacency, with a noticeable pickup in conversions from earlier touring cycles. Well-located, move-in-ready floors continued to trade efficiently, while extended negotiation timelines became increasingly difficult to sustain as competitive alternatives narrowed. For tenants requiring scale, the market has favored those able to move decisively and commit early in the planning cycle.

A notable exception and key availability event is 340 Madison Avenue, recently acquired by Barings through auction earlier this year. Ownership has since brought approximately 400,000 SF of office space to market, creating one of the few opportunities in the broader Bryant Park South area that can accommodate either a single large-block user or multiple smaller tenants through custom-built configurations. The introduction of this inventory offers rare flexibility at scale and has been positioned deliberately rather than opportunistically, reflecting confidence in sustained demand.

Nomad’s Choice: 1450 Broadway – Entire 25th Fl (7,735 SF) $48K / Month ( 2x Private Terrace😎)

The Nomad Notion

Manhattan’s Office-to-Residential Boom Is Quietly Setting Up the Next Office Shortage

By William Janetschek – COO & Co-Founder, Nomad Group

Over the past two decades, NYC developers have converted nearly 30 million square feet (MSF) of office space into residential use, quietly reshaping the city’s landscape. What began as a cyclical response to downturns has evolved into a structural reallocation of space, one that is now accelerating as office obsolescence, housing scarcity, public policy, and design innovation converge.

For much of modern history, office buildings were viewed as poor candidates for residential conversion. Deep floor plates, limited access to light and air, and complex mechanical systems made adaptation expensive and inefficient. Today, developers and architects have expanded the playbook. Carved light wells, structural notches, selective floorplate removals, and core reconfigurations enabling residential layouts in buildings once considered unconvertible. As a result, a significant portion of Manhattan’s aging office inventory is being permanently removed from the commercial market.

From cyclical response to structural shift

New York’s first major conversion wave followed the early-1990s recession, concentrated in Lower Manhattan. Roughly 100 buildings were converted between 1995 and 2006, aided by generous tax incentives. Another 125 buildings totaling 19.5 million square feet were repurposed between 2005 and 2019, largely downtown, before activity slowed as office demand recovered.

The pandemic marked a decisive inflection point. Office vacancy surged past 20%, reopening the conversion equation at scale. In response, New York State and City enacted new tax abatements and zoning reforms, dramatically expanding the pool of eligible buildings. Today, dozens of projects / MSF are either underway, approved, or in planning conversions across Manhattan.

While Lower Manhattan remains a conversion epicenter, Midtown has emerged as the next frontier. Since the pandemic, roughly half of all announced conversions are in Midtown, a sharp departure from earlier cycles dominated by FiDi assets. High-profile examples include the former Pfizer headquarters on East 42nd Street, 5 Times Square, and 750 Third Avenue, an 818,000-square-foot tower where aggressive floorplate surgery is unlocking nearly 680 apartments by the end of the decade.

Keep reading on our website linked below!

Download the full report below!

Let’s elevate your workspace—and your future.

Partner with Nomad Group for expert guidance, full-scale support and an enjoyable experience that prepares your team for a thriving future.

Get started

Featured resources

From commercial real estate fundamentals to extensive reports, stay in the know with Nomad Group’s insights, strategies and expert perspectives on office leasing.

Explore resources

Customers Over Everything: Ditch the Short-Term Profit Trap & Build Durable Growth

By Matthew DeRose – CEO, Nomad Group In hip‑hop, “Money over everything” might be a flex. In business, it’s a…

From Flex to Flagship: Knowing When to Make the Move

By Matthew DeRose – CEO, Nomad Group Coworking vs. Private Office Space: What CEOs Should Really Be Thinking About When…