Market Report: Q2 2025

EXECUTIVE SUMMARY

Q2 2025 Moderation but Ongoing Strength:

After the Q1 spike, leasing cooled in Q2 2025 yet remained historically solid. Preliminary data shows Manhattan office leasing totaled nearly 9.0 million square feet (MSF) in Q2 2025, bringing the first-half of 2025 volume to over 21 MSF – up roughly 36% year-over-year (H1 2024 was 15.5 MSF).

2025 is on pace to be the most active post-pandemic year; H1 2025 leasing surpassed the pre-pandemic average for a half-year and marks the strongest start since 2014. By comparison, Q2 2024 saw 8.7 MSF leased.

Tenants continue to transact in significant numbers, albeit with fewer blockbuster deals than Q1.

LARGEST TRANSACTIONS OF Q2

With 17 leases over 50,000 square feet (SF) in Q2, down from 21 in Q1, large-scale leasing remains active, though slightly tempered. Notably, the majority of these deals involved expansion space within premier Class A and trophy assets, as firms secured additional SF either within their current buildings or adjacent properties due to constrained availability. This trend underscores the sustained tenant demand for high-quality space in Manhattan’s most prestigious assets.

One of the most significant transactions of the quarter was Deloitte’s commitment to establish its headquarters at 70 Hudson Yards, securing 800,000 SF within the forthcoming 1.1 MSF Class A tower.

DELOITTE | 70 HUDSON YARDS | 800,000 SF

This was the largest transaction of the quarter. Deloitte’s 800,000 SF pre-construction lease at 70 Hudson Yards, one of the largest office deals in New York post-pandemic, signals a bold headquarters relocation from Rockefeller Center to a next-generation, zero-carbon tower. Slated to break ground in June 2025, the 1.1 MSF development reflects growing demand for highly amenitized, sustainable office space. With features like private terraces, red-eye suites, and a podcast studio, the deal underscores Deloitte’s commitment to workplace innovation.

UNITED NATIONS | 2 UNITED NATIONS PLAZA | 425,190 SF

This was one of the top five leases of the quarter. Although not a private-sector tenant, the UN’s recommitment underscores that even large institutions are maintaining significant office footprints.

INVESCO | 225 LIBERTY STREET | 200,000 SF

Invesco has reaffirmed its commitment to 225 Liberty Street, part of Brookfield Place in Lower Manhattan, by renewing approximately 200,000 SF of prime office space as of July 2, 2025. The deal maintains Invesco’s substantial presence in the Financial District, though specific lease duration and final rental rate were not disclosed; however, listings for similar floors in the building suggest rents around $72 per SF.

BENESCH | 1301 AVENUE OF THE AMERICAS | 121,000 SF

Benesch’s move to 1301 Avenue of the Americas propels a strategic expansion with a 121,000 SF, 16.5‑year lease, including 30,000 SF of short-term space. The deal underlines both the firm’s long-term growth vision and the resilience of prime New York office real estate. With Benesch’s lease executed, the building is now approximately 90% leased.

DECLINING VACANCY AND AVAILABILITY RATES

Availability on the Decline:

As we enter Q3 2025, both tenants and brokers are grappling with a tightening market. Since May, inventory constraints have become increasingly evident; over the past 45 days, quality spaces have been absorbed rapidly, with minimal new supply coming online.

Robust leasing activity is starting to chip away at Manhattan’s office oversupply. All major brokerages reported declining vacancy rates in early 2025, both quarterly and annually. Overall availability fell to 16.4% in Q2-25, the lowest in over 4 years, down 320 basis points from 19.6% in Q2 2024 and 150 points from 17.9% in Q1 2025. Manhattan is clearly moving beyond oversupply: leasing volumes are accelerating, vacancy is decreasing significantly, and the availability level is returning to pre-COVID territory.

Vacancy vs. Availability

The overall vacancy rate reduced to 22.7% in Q2 2025, down 70 bps year over year, the first annual decline in vacancy since 2018.

This figure is higher than the availability stats above because it likely includes all vacant space (whereas some firms report availability). Importantly, the vacancy/availability trend has turned a corner. After peaking in the pandemic, Manhattan’s office availability is now receding, highlighting that Q2 2025 was the fifth consecutive quarter of improving demand.

While Manhattan’s office availability remains above pre-2020 norms, historically in the 10–12% range, the market is demonstrating meaningful progress toward equilibrium. Current availability hovers between 16–18%, a notable improvement from the peak of approximately 20–21% seen just a year ago. Although still roughly 5 percentage points above the long-term average of 13–14%, the continued decline reflects sustained leasing momentum and growing tenant confidence, signaling a gradual but steady recovery in the city’s office sector.

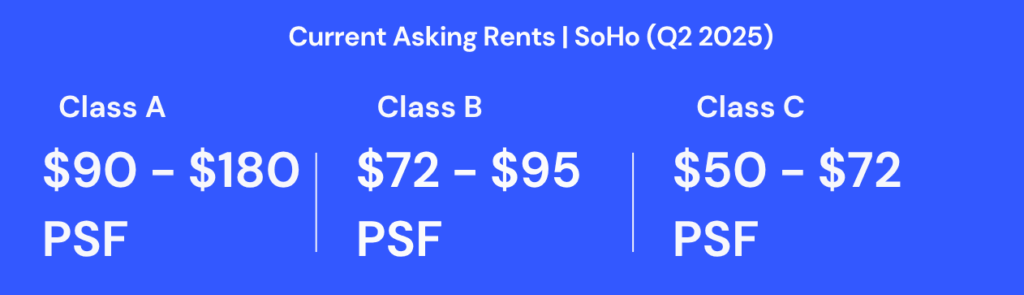

WHAT’S TRENDING IN SOHO?

NYC’s Most In-Demand Office Neighborhoods | Q2 2025

For forward-thinking tech companies planning their next chapter, SoHo continues to stand tall as Manhattan’s most desirable creative office destination. As we close out Q2 2025, the competition for quality space in SoHo has intensified, driven by nearly non-existent supply.

SoHo: A Tight Market for a Premium Brand Presence

Q2 has established the trend that began to emerge in Q1: SoHo’s office inventory is being absorbed at a pace that outstrips replenishment. Over the past 90 days, we’ve seen some of the most desirable spaces, particularly in the 5,000 – 10,000 SF range, taken off the market with little to no immediate backfill. The continued migration to SoHo appears to be driven largely by early-stage AI startups, many of which are fresh off significant Series A and B fundraising rounds. With industry leaders like OpenAI setting the tone, a wave of ambitious, up-and-coming AI founders are actively positioning their companies alongside the industry defining titans.

Average asking rents now range from $90–$180 PSF for Class A spaces, depending on floorplate size, finishes, and whether the space is delivered furnished. Turnkey and fully built spaces, especially those on Greene, Wooster, and Crosby Streets, are commanding significant premiums and are often leased / subleased within days of hitting the market.

Transit accessibility via the C/E, R/W, 6, remains functional, though companies with larger commuter teams from outer boroughs or New Jersey should factor in longer walking connections. Still, for those optimizing for culture, client experience, and a space that truly reflects their brand, SoHo continues to lead the pack.

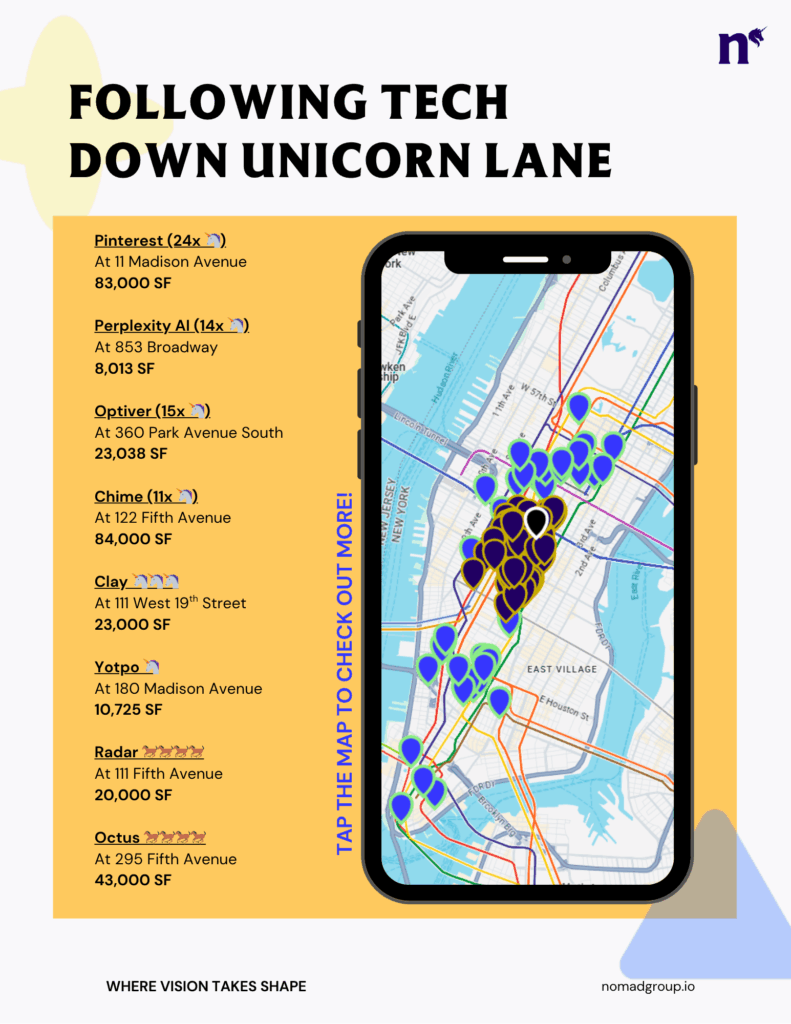

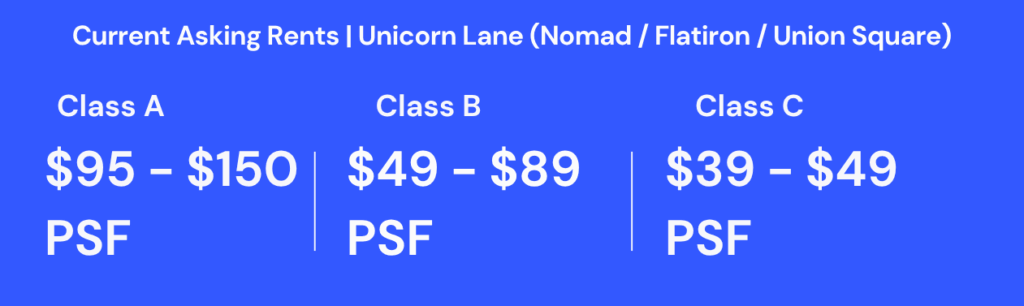

RIDING ALONG UNICORN LANE

NYC’s Most In-Demand Office Neighborhoods | Q2 2025

NoMad’s upward trajectory continues into Q2 with rising demand and modest price gains across all building classes. The average asking rent has climbed from $49.75 PSF in Q1 to approximately $51.00 PSF in Q2, still offering tenants a 35–40% discount compared to SoHo, but now with increasing urgency as larger tenants begin to take space off the market.

With most inventory getting leased up within the Union Square and Flatiron submarket, the push has been north of Madison Square Park, to NoMad; this neighborhood continues to solidify itself as Manhattan’s most balanced commercial submarket. Its reputation as a hub for innovation and design remains intact, and Q2 has proven that momentum is not slowing.

At 900 Broadway (Class B Asset), Nomad unveiled a workspace where residential warmth, hospitality-level luxury, and a top-tier office collided, offering something truly remarkable! The result? A three-way bidding war and a lease signed at triple-digit rents, a new high for Justin Management’s portfolio.

From Sequoia-backed startups fresh off major funding to quintuple unicorns, industry giants are making bold moves to plant their flag at the center of the action.

Why Everyone Wants to Be Here

Whether it’s the unmatched transportation convenience for employees, clients, and guests, or the abundance of fast-casual dining, upscale restaurants, bars, hotels, and experiential venues, this neighborhood offers an exceptional blend of accessibility and lifestyle. As companies return to the office, they’re prioritizing both connectivity and quality of life, and NoMad delivers on both fronts.

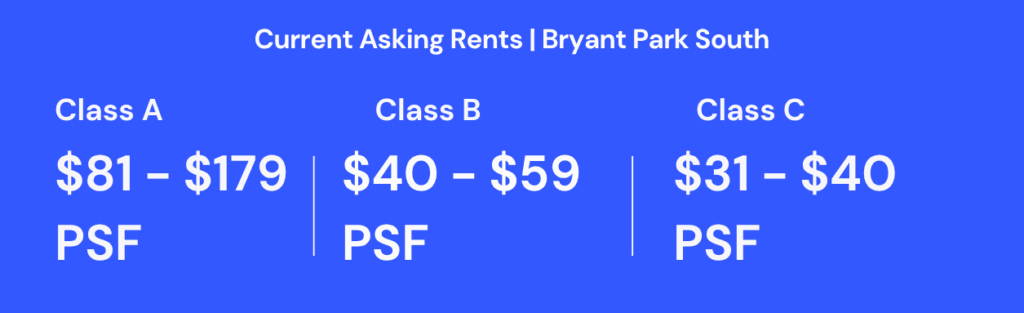

BRYANT PARK SOUTH’S VALUE EDGE

NYC’s Most In-Demand Office Neighborhoods | Q2 2025

Stretching from 35th to 39th Street between 5th and 7th Avenues, Bryant Park South is attracting a new wave of tenants, from digital marketing firms and VC-backed startups to boutique FinTech companies, all lured by walkability, affordability, and infrastructure. The area’s positioning between Penn Station, Grand Central, and Port Authority creates an unbeatable transit triangle that’s ideal for distributed teams navigating hybrid schedules.

Micro-Location Matters

Q2 is making one thing crystal clear in this neighborhood: quality wins. Buildings that deliver updated lobbies, modern elevators, and turnkey pre-builts are commanding premium attention, even when located just feet from lesser options. A prime example is a newly built asset (2018) at 44 West 37th Street, fully furnished, good natural light, and smartly built. It’s getting the tours and traction, while tired, second-gen offices right next door at 50% discounted sit stagnant. Today’s tenants are savvier than ever, and unless a space offers real value in design and experience, they’ll keep walking.

Looking Ahead

With leasing velocity gradually increasing and incentives beginning to tighten, Bryant Park South is well-positioned for continued absorption into Q3. For companies seeking centrality, cost efficiency, and a ready-to-work environment, this corridor continues to deliver maximum ROI PSF.

THE NOMAD NOTION

The Flight to Quality Becomes the Standard

By Nicholas Hein – Director, Nomad Group If one theme defined NYC commercial leasing in Q2 2025, it was “Flight to Quality.” Once a buzzword, it’s now the baseline. Landlords, tenants, and brokers are aligned: quality space is no longer a differentiator, it’s the cost of entry.

Download the full report here!

Let’s elevate your workspace—and your future.

Partner with Nomad Group for expert guidance, full-scale support and an enjoyable experience that prepares your team for a thriving future.

Get started

Featured resources

From commercial real estate fundamentals to extensive reports, stay in the know with Nomad Group’s insights, strategies and expert perspectives on office leasing.

Explore resources

Customers Over Everything: Ditch the Short-Term Profit Trap & Build Durable Growth

By Matthew DeRose – CEO, Nomad Group In hip‑hop, “Money over everything” might be a flex. In business, it’s a…

From Flex to Flagship: Knowing When to Make the Move

By Matthew DeRose – CEO, Nomad Group Coworking vs. Private Office Space: What CEOs Should Really Be Thinking About When…